Over the past few years there has been a surge in mainstream interest surrounding wine as investment. With volatility and uneasiness surrounding the stock market, high levels of sovereign debt and a lack of confidence in governments, both foreign and domestic, more and more people are looking to non-financial assets for a portion of their portfolio.

Last Wednesday on CNBC’s Squawk Box, Scott Minerd, Chief Strategist and CIO of Guggenheim Partners, was discussing the viability of non-financial assets at a time when structural issues cast a massive shadow over the U.S. and Europe. Albeit he was speaking of these assets as a hedge, it strengthens this arena’s appeal as a viable investment. Whether it’s antiques, art, diamonds, or wine, there’s something comforting about investing in something tangible.

This comfort should not be the only reason that you invest in these assets, there must be the potential to make money as well. When looking at the Liv-Ex 500, a region-weighted index based on current best (cheapest) list price, in comparison to the S&P 500 or any other major equity index, one can quickly see the value that wine can add to your portfolio.

There has been no “Lost Decade” when it comes to the fine wine world; however it’s important to truly understand the risk and involvement necessary to obtain these figures. (Source: Liv-Ex.com)

The potential for big returns is all well and good; however one should always consider the risks involved in investing in non-financials. When investing in wine, there are three primary risks that one should clearly understand:

Liquidity Risk: the risk that you won’t be able to convert your asset quickly into cash. Although a liquid, wine is highly illiquid as an asset, as it may take weeks and potentially longer to find buyers for your collection.

Principal Risk: the risk that the wine you selected will depreciate in value causing you to lose principal. This is why the selection of viable investment wines is so important.

Storage Risk: as with any physical investment storage is always something that needs to be considered. Improper storage can lead to spoilage, theft or damaged goods. To prevent against theft or damage, be sure to contact your homeowner’s insurance provider. Conversely, wine when properly stored can increase in value significantly.

With the key risks being covered, let’s look at seven rules that will help you create an appreciating investment cellar.

Rule 1: Create a plan!

This seems intuitive; however the importance of having a plan can’t be stressed enough. You’d be shocked by how many investors purchase wines on impulse. Everything, from what, to how much, to when to buy and when to sell should be plotted out well in advance. If not, you run the risk of misappropriating your funds on the wrong wines.

Think of your wine portfolio in the same manner as your investment portfolio. To successfully manage your wine portfolio you need to follow five basic guidelines:

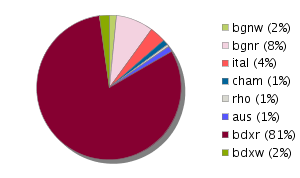

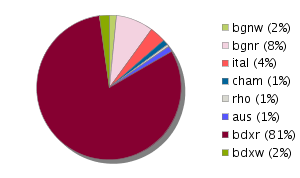

- Asset allocation and diversification:What regions do you want representing your core holdings (could be more than one)? What region’s wines do you want to compliment the core and at percentage? This is also the time to start breaking down the portfolio by vintage as well. Basically you want different lots coming due at different times; so create a plan for vintage selection as well.

A sample allocation by region, meant for illustration purposes only. Although Bordeaux-heavy it illustrates the use of other regions for diversification. (Source: Liv-Ex.com)

- Research: Once you decide your allocation, begin to research the wines from the regions you’ve selected and begin to narrow them down based on your criteria. Once you’ve isolated the ones you want, begin monitoring them and find the most cost effective source from which to purchase. I’d also recommend having a few back-up wines in mind as well, as you may come across a bargain that makes more sense. It’s all about margins!

- Invest: Begin implementing your strategy by making the purchases. Depending on the region you’re featuring in your cellar, you may have to decide whether you purchase your wine en primeur, or futures, or at release. Typically, en primeur prices are lower than the release price by a decent amount. Plus even within en primeur the wines are released in different traunches with each subsequent being more expensive, so having a plan helps you capitalize. To receive this preferential pricing, you’re buying wines that are still aging in an oak barrel somewhere and won’t be shipped for a couple years, thus tying up your capital. When purchasing wines at release, it’s vital that you have a good relationship with a reputable wine shop. They can provide two things: better pricing and access to rare wines. This relationship is essential due to the typical three-tier system.

- Manage: This is the difficult part, whether investing in stocks or wine. You need to have the discipline to review your portfolio on a set schedule and analyze your current holdings and make changes when appropriate. If you do your planning up front, this part is far easier, because you already know when certain wines should be sold due to progress in age. By this I mean when wines reach a certain level of maturity, restaurants and consumers begin to look for those bottles, thus there’s increased demand and limited supply. They pay the premium for the work you’ve done. Also, assess the wines that aren’t living up to their potential as an investment. There’s nothing wrong with cutting your losses if a wine has lost momentum in the marketplace. You can always replace them with another wine you’ve been researching and deemed a viable replacement. Finally, cash in or scale back on your winners, investing is only worthwhile if you can make money!

- Your representative: You want to be able to sell your wines in the most efficient manner while generating the most buzz for your lots. Continually reevaluate what secondary vendor you use to sell the lots you’re looking to move. Your four options are retail, broker, online auction and live auction. Each option has its pluses and minuses. Each represents you as the seller differently and at a different cost. What’s good for one lot may not be the same for another.

Rule 2: “Blue Chips” are your best friends

Auction houses and other investors are rarely interested in what cool, esoteric wines you’ve discovered. Very few wines go on to become Screaming Eagle or Sine Qua Non and even fewer would-be buyers care about which wines you enjoy. I’m not being a jerk, only a realist.

Although there’s a niche market for obscure wines, “Blue Chips” are the way to go. These wines are your huge names in the auction market that will have heavy demand many years from now. Since liquidity is always a risk to keep in mind, these wines should make up a majority of your cellar because of the activity they generate. Remember, when dealing with any region, the prestige of the vineyard is as important as the producer. There’s plenty of Schafer out there, but it’s the Hillside Select that collectors look for, not the 1 Point 5. With that being said, I’ve broken this group into a rudimentary two tiers system (which should be broken down further within the tiers; however for the sake of not making this article unbarably long I’ve left them combined):

Tier 1 – Wines that are historically the most sought after and lucrative in the world wine market, hence limited supply and higher demand. These are the wines you’d likely consider as part of the core of your wine portfolio.

Tier 2 – Are wines that have more traction within certain specialized niches. This means that the demand is primarily coming from smaller pockets within the broader world market. They may not be Bordeaux, but they do offer some opportunities to those who are selective. These wines are typically seen as a way to compliment the core so tread lightly.

Tier 1

- Bordeaux: Although I’ve been critical of the Bordelais and their pandering to the Chinese passion for their wines, there’s no more important region when it comes to investing. Look to Left Bank First Growths and Super-Second Growths, as well as the best of the Right Bank (i.e. Petrus and Cheval Blanc) and d’Yquem, the mighty Sauternes. I’d even lump in the Second wines of the First Growths into this category as a diversification tool (see chart and subscript below). With the recent success of the ’09 and ’10 futures offering, there’s solid availability of other optimal vintages, namely ’05, ’03 and ’00. Also look to ‘shadow vintages’ such as ’06 and ’01 as they are largely overlooked due to their legendary predecessors. Although you pay a premium, Bordeaux should be considered the core of your core holdings.

- Champagne: Stick with the best houses from the best vintages as they are the place to be when it comes to bubbly. There’s a reason why Krug, Veuve’s La Grande Dame, Roederer’s Cristal and Dom Perignon have the prestige typically associated with them.

- Burgundy: Stick to red (for the most part), Premier and Grand Crus only and try to avoid negociant wines, domaine wines are certainly preferable. Look predominantly to wines from Côte de Nuits for the most viable interest. There’s a lot of traps in Burgundy, so be careful!

- Northern Rhône: Hermitage, Hermitage, Hermitage! This appellation is the most prestigious to investors. Names like Chave, Guigal, Jaboulet and Chapoutier should spring to mind.

- Southern Rhône: The best of Chateauneuf-du-Pape and only the best Chateauneuf-du-Pape. And by the best, I mean the best from the best. There’s a glut of CdP which isn’t a good sign; however the best offering from the top of the line producers are still strong, especially Beaucastel, Pegau and Clos de Papes.

- Australia: For the most part, outside of legendary Penfolds Grange and to a far lesser extent Torbreck RunRig and Clarendon Hills Astralis, there isn’t a vast demand for Australia. They certainly produce some iconic wines; however there’s a very small secondary market for most others. BUT, if you can put together a collection of Grange, you’ll be smiling.

- Tuscany: Super-Tuscans, such as Sassicaia and Ornellaia, are the real attention grabbers and should be the focal point of the Italian portion of your wine portfolio, if you want to have an Italian portion that is. Even then, focus only on the best vintages. There’s also potential for Brunello di Montalcino as they’re generating some deserved buzz, but don’t go crazy with them. I consider BdM Tier 2.

- Napa: Only estate and non-corporate/pre-corporate wines should be considered, with the only exception being Opus One. If a winery sources their grapes, they’re not necessarily a good investment, fair or not; however there’s always a few exceptions to this rule. Stick with the big guns with a solid track record and strong demand (i.e. – Bryant, Bond, Colgin, Harlan, Joseph Phelps, Screaming Eagle, Shafer, etc.). There are also a few new or reinvented wineries making a push to be considered blue chips, with two names, Schrader and Chappellet, breaking through the headwinds.

Although flat in 2011, Second wines of Bordeaux First Growths diversification potential while capitalizing on the name. In my opinion, the flat start to 2011 has been cause by two major headwinds. The first being monies being redirected towards 2010 futures. The second being the geopolitical issues of 2011 causing some wine money to stay in the pockets for the time being, which is a healthy market reaction. Watch this area closely. (Source: Liv-Ex.com)

Tier 2

- Bordeaux: This time around we’re looking at Third through Fifth Growths; however not all of them. Some have more traction than others, be tactical here as some can really excel. Just ask the fans of Pontet-Canet.

- Ribera del Duero & Rioja: The only regions in Spain with enough demand and only the top wines from the biggest names such as Vega Sicilia, Lopez de Heredia, Pingus and Numanthia-Thermes from these regions garner consistent attention.

- Piedmont: Angelo Gaja holds down the fort when it comes to Piedmont and has strong investor appeal, thus Gaja is Tier 1. Outside of Gaja, I feel as if Piedmont, and Italy in general, has been relegated to Tier 2. There’s some additional interest in the likes of Luciano Sandrone, Robert Voerzio and Bruno Giacosa, but these should only be viewed as options in the very best of vintages. Call me a skeptic, but I wouldn’t create a collection around them.

- Germany: Riesling is king of white wines when it comes to devotion and cult status. Focus primarily on Spätlese, Beerenauslese, Trockenbeerenauslese from Wehlener Sonnenuhr from and obviously from the best vintages. Not a huge market; however they do well as they’re increasingly hard to find due to most being consumed near initial release.

- New Napa and Other California: This is where things get a bit tricky. There are a lot of exciting wines being made in and outside of Napa; however that doesn’t necessarily mean that they make for a sound investment. Recent auctions reaffirmed Sine Qua Non as the most highly sought-after non-Napa from California. Other than SQN (which is Tier 1 caliber), Saxum continues to do well, with a few others garnering some interest.

- Chile: Very interesting from a consumer standpoint, but Chile doesn’t have a great track record at auction. Although, Casa Lapostolle’s sensational Bordeaux-styled Clos Apalta has been a new arrival to the demand portion of some auctions. There’s certainly another producer to watch in Almaviva; however there’s very little interest in other Chilean wines.

Rule 3: Buy cases when possible

If you have the means to purchase wines by the case do so. This simple act could increase the value of those wines. Lots maintained in their original case typically garner 10-15% more than broken cases at auction (those which have been opened and are no longer a complete case).

Collectors, especially the Chinese, love when wines have been aged in their original cases, especially if they’re Tier 1 wines in wooden cases. What the cases ensure is that the wines haven’t been handled or tampered with, which typically indicates better provenance (history of the conditions of storage). Considering the Chinese are currently driving demand, it’s best to know what they prefer.

Rule 4: You break it, you bought it!

If you’re purchasing wine as an investment, don’t disturb the bottles. Besides the potential to drop your investment and render it worthless, wine also ages best if undisturbed. Although inanimate objects, there’re very few things more interesting to look at then a great bottle of wine for a wine collector.

Then there’s always the temptation to pop the cork on a great bottle. You must exercise self-control. One way to fight the urge is to purchase a loose bottle or two for your enjoyment along the way and leave the investments in their cases.

Rule 5: Storage

If you don’t have a proper place to store your wine (i.e. – a cool basement with steady year-round temperature, a temperature controlled cellar or professional storage facility) then don’t start collecting just yet. Without appropriate cellar conditions, your wines could possibly depreciate. Auction houses and websites look for telltale signs of poor storage: abnormal ullage levels, seepage, mold, discoloration, etc. At the point of sale, these imperfections are brought to the attention of would-be bidders or buys, potentially limiting your wine’s upside if not rendering it unsold.

When considering storage, a few things should be kept in mind. A consistent temperature around 52-54 degrees and 70% humidity is widely seen as optimal, as well as a lack of exposure to ultra-violet light. Outside of volatile temperatures, UV exposure is the most damaging of all elements to a bottle of wine.

Rule 6: Provenance

Provenance is the most important word in the world of wine collecting. This is recent and significant, as we are in an era of increased awareness and skepticism towards rare or high-valued wines. Provenance isn’t a concept just for the big investors either. There’s increased demand that you know where your wines came from and how they’ve been stored when you plan to resell or bring them to auction. For high-end investors, companies such as Bordeaux Wine Bank play a vital role in their strategy.

—

Finally, there is the PR factor. This isn’t so much a rule, but a helpful suggestion. Considering most investors don’t have the opportunity to try all of the wines they invest in, they look to sources to confirm quality. As much as many people don’t want to admit, wine critic Robert Parker is the only voice that carries any cache in the wine investment market, so pay attention. When “The Emperor” speaks, investors listen. This is especially true when he reassesses a previous rating, it can cause a great surge or dive in a wine’s value.

These basic rules should serve as a good starting point in creating an appreciating investment cellar. Remember, these are rules for investing in wine, which is completely different from collecting wine for your personal enjoyment.

The keys to investing in wine, as with investing in anything else: appreciate the risks, have a well thought out plan, reduce your margins where possible (i.e. having a good relationship with a reputable wine shop), adhere to that plan with strict discipline and finally, revisit that plan regularly. Remember that the wine market is similar to the stock market in that it’s ever evolving, so your active participation is a must in order to be successful. Also remember that there’s one significant difference, wine tastes so much better than a stock!

If the wine sees time in a barrel, then there are more additions and changes to the structure of the juice with tannins, vanillin and slight oxidation taking place. By the time the wine reaches the bottle, it’s gone through huge amount of change. For those who are skilled in the kitchen and have made a soup or stew, there’s the adage that it’s always better the second day, and this holds true to wine. It takes a while for the ingredients in a wine to mesh and aging a wine will give it the necessary time to reach that optimal state.

If the wine sees time in a barrel, then there are more additions and changes to the structure of the juice with tannins, vanillin and slight oxidation taking place. By the time the wine reaches the bottle, it’s gone through huge amount of change. For those who are skilled in the kitchen and have made a soup or stew, there’s the adage that it’s always better the second day, and this holds true to wine. It takes a while for the ingredients in a wine to mesh and aging a wine will give it the necessary time to reach that optimal state.  Michael is a Master Sommelier Candidate is in the process of completing his Diploma of Wine Studies from the WSET. Being a former collegiate athlete, he is now focusing that competitive spirit on the wine world. He won the 2010 Chaine de Rotisseurs Best Young Sommelier competition, finished third at TOP|SOMM The US Sommelier Championships. He also serves as Chairman of the Boston Sommelier Society and owner of the beverage consulting company, Sommelier On-Demand.

Michael is a Master Sommelier Candidate is in the process of completing his Diploma of Wine Studies from the WSET. Being a former collegiate athlete, he is now focusing that competitive spirit on the wine world. He won the 2010 Chaine de Rotisseurs Best Young Sommelier competition, finished third at TOP|SOMM The US Sommelier Championships. He also serves as Chairman of the Boston Sommelier Society and owner of the beverage consulting company, Sommelier On-Demand.